If you’re running a small business in Jamaica, you’ve probably asked yourself a version of this question:

👉 “Is payroll part of HR… or is it more of an accounting thing?”

The truth is, payroll doesn’t fit neatly into just one box. It’s closely tied to HR, overlaps heavily with bookkeeping and accounting, and yet stands as its own critical function. Let’s unpack it in simple terms.

What Payroll Really Means

At its core, payroll is the process of compensating your employees. But it’s much more than just writing a cheque at the end of the month. Payroll involves:

-

Figuring out gross pay (hours, salary, bonuses, overtime)

-

Deducting things like PAYE, NIS, NHT, and Education Tax (especially here in Jamaica)

-

Remitting those deductions to the government

-

Ensuring staff receive their net pay on time, every time

So, when we talk about payroll, we’re talking about the entire cycle of employee compensation and compliance.

So… Is Payroll HR?

Not exactly. HR (Human Resources) is all about the people side of your company — hiring, contracts, training, performance reviews, and workplace culture.

Payroll, on the other hand, is about the money side of employment. That said, HR and payroll are deeply connected. HR decides things like:

-

Who’s hired and when they start

-

Salary levels and benefits packages

-

Promotions, pay raises, or disciplinary deductions

Without HR decisions, payroll wouldn’t know what to pay. But the actual calculation and disbursement of money? That’s payroll territory.

Fact Spotlight – Jamaican SMEs & Payroll Compliance

A recent study shows that 84% of small businesses worldwide face payroll compliance errors and while this is a global figure, the complexity of Jamaican payroll (with PAYE, NIS, NHT, Education Tax, and HEART contributions) suggests local SMEs likely face similar challenges. Research indicates that maintaining both payroll and HR functions without a streamlined system often leads to costly mismanagement.

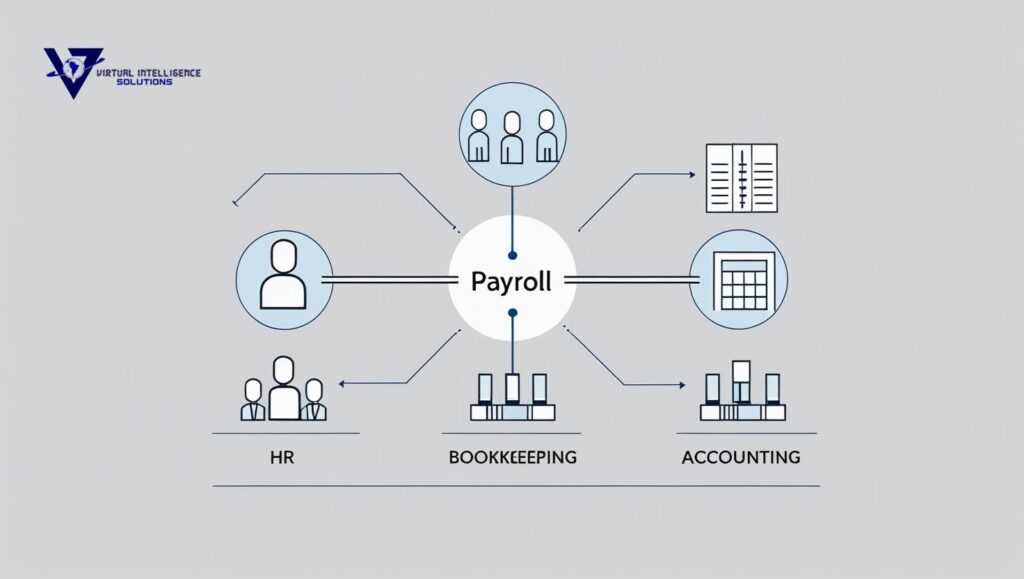

Payroll vs Bookkeeping vs Accounting

Here’s where things overlap even more.

-

Bookkeeping → Think of bookkeeping as your official financial diary. Every expense, including wages, gets written down. Payroll expenses (salaries, taxes, deductions) must all be recorded by the bookkeeper.

-

Accounting → Accountants step in to analyze the numbers. They use payroll data to prepare financial statements, calculate overall tax liability, and help with budgeting.

-

Payroll → Payroll feeds data into both bookkeeping and accounting. It’s the bridge between “people management” (HR) and “financial management” (accounting).

A Simple Analogy to Clear Things Up

Picture your business like a car:

-

HR is the driver, choosing the direction, deciding who’s in the vehicle, and how they’re treated.

-

Payroll is the engine, making sure the fuel (money) gets to where it needs to go.

-

Bookkeeping is the dashboard, showing the numbers and keeping records of what’s happening.

All three have different roles, but none can function properly without the others.

Why Payroll Can’t Be Ignored

When payroll is mismanaged, it’s not just your team that feels the impact, governments do too. Late tax submissions, inaccurate PAYE deductions, or poorly tracked benefits can lead to penalties that can cripple a small business.

This is why many SMEs in Jamaica either:

-

Struggle with manual payroll setups (like Excel templates), or

-

Hand it off to third-party payroll services that charge ongoing monthly fees.

But there’s a smarter path: own your payroll system outright. Instead of renting payroll through subscription software, you can have a system built for your business that belongs to you — for life.

Frequently Asked Questions About Payroll, HR, and Bookkeeping

Q1: Is payroll part of HR or accounting?

Payroll is its own function but overlaps with both. HR decides employee-related matters, accounting tracks the financials, and payroll connects the two.

Q2: What’s the difference between bookkeeping and payroll?

Bookkeeping is about recording all business transactions, while payroll specifically manages paying staff and deducting taxes.

Q3: Does payroll fall under HR?

In small businesses, yes, payroll is often managed by HR. In larger organizations, payroll may fall under finance or be a separate department altogether.

Q4: How do payroll and bookkeeping work together?

Every payroll run produces transactions (wages, taxes, deductions). These transactions must be logged in the bookkeeping system.

Q5: Why is payroll important for small businesses?

Because getting payroll wrong can mean unhappy employees, tax penalties, and a shaky business foundation.

Final Takeaway

So, is payroll part of HR? Not quite. It’s not fully accounting either. Payroll is its own function that acts as the link between managing people and managing money.

For SMEs, the smartest move is to invest in a payroll solution that doesn’t lock you into monthly subscription fees. At Virtual Intelligence Solutions, we build payroll systems that are simple, compliant, and yours forever — just one-time payment, no strings attached.

👉 Want to stop juggling HR, payroll, and bookkeeping headaches? Book your free consultation with us today

Other Topics You Might Like:

- Payroll Taxes Jamaica 101: Cracking What Every Smart Business Owner Should Know

- How to Pay Employees Without Payroll And Keep Your Sanity as a Small Business Owner!

- Payroll vs HR vs Bookkeeping: Untangling the Confusion for Business Owners

- How Payroll Works: A Complete Guide for Business Owners

- App Development vs Web Development: Which One Does Your Jamaican Business Need?